Forex exchange trading, commonly referred to as forex trading, is the act of buying and selling currencies with the aim of making a profit. It is one of the most dynamic and accessible trading arenas available today, allowing traders from all walks of life to engage in the global market. In this article, we will explore the essentials of forex exchange trading, covering everything from fundamental concepts to advanced strategies, and we will direct you to valuable resources like forex exchange trading trading-terminal.com that can enhance your trading journey.

Understanding Forex Market Basics

The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, due to its global nature. Currencies are traded in pairs, with the exchange rate representing how much of the second currency you need to spend to purchase one unit of the first currency. The most popular currency pairs are known as the major pairs, which include EUR/USD, USD/JPY, and GBP/USD.

Key Concepts in Forex Trading

- Pip: The smallest price move that a given exchange rate can make based on market convention. For most currency pairs, this is equivalent to 0.0001.

- Leverage: A tool that allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of significant losses.

- Margin: The amount of money required to open a leveraged position. Traders must maintain a certain balance in their account to keep their positions open.

- Spread: The difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). Spreads can vary based on market conditions and the broker you choose.

Types of Forex Traders

Forex traders can generally be classified into three main categories based on their trading styles:

- Day Traders: These traders typically open and close positions within the same trading day and do not hold any positions overnight to avoid overnight risks.

- Swing Traders: Swing traders hold their positions for several days or weeks, aiming to profit from short- to medium-term market movements.

- Position Traders: These long-term traders may hold positions for months or even years, relying on fundamental analysis to make their trading decisions.

Forex Trading Strategies

Successful forex trading often hinges on having a well-thought-out strategy. Here are some popular trading strategies employed by traders worldwide:

- Technical Analysis: This strategy involves analyzing price charts and patterns, as well as using indicators to identify potential trading opportunities. Traders who utilize technical analysis often rely on support and resistance levels, trend lines, and various chart patterns.

- Fundamental Analysis: Fundamental traders assess economic indicators, geopolitical events, and other macroeconomic factors that can influence currency values. This can include news releases related to interest rates, employment data, and GDP growth.

- Scalping: This is a very short-term trading strategy aiming to make small profits from minor price changes. Scalpers often enter and exit trades within minutes, requiring quick decision-making and precise execution.

- Trend Following: Trend-following traders aim to capture the momentum of a market trend. They buy when prices are rising and sell when prices are falling, often relying on tools like moving averages or trend lines to identify the direction of the trend.

Risk Management in Forex Trading

Even the most successful forex traders cannot eliminate risk entirely. However, they can mitigate it through effective risk management strategies. Here are several key principles to consider:

- Use of Stop-Loss Orders: A stop-loss order automatically closes your trading position at a previously determined price level, helping you limit potential losses.

- Position Sizing: Properly managing the size of your positions can protect your account from significant loss. A common rule is to risk no more than 1-2% of your capital on a single trade.

- Diversification: Diversifying your trading portfolio by investing in different currency pairs can help spread risk and prevent overexposure to a single trade.

Choosing a Reliable Forex Broker

Selecting a reputable forex broker is crucial for your trading success. Here are some attributes to look out for:

- Regulatory Compliance: Ensure that the broker is regulated by a recognized authority, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

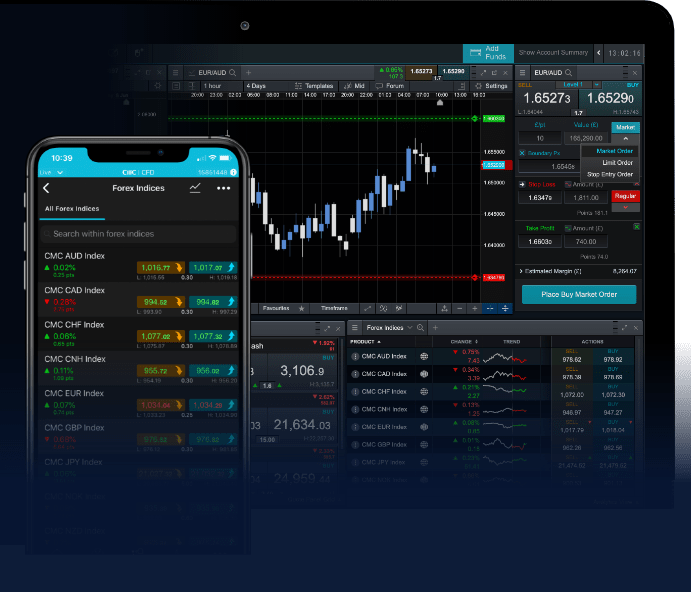

- Trading Platform: Make sure the broker offers a user-friendly and reliable trading platform that meets your trading needs.

- Customer Support: Good customer service can make a significant difference, especially when you encounter issues or have questions regarding your trades.

- Fees and Spreads: Compare trading costs, including spreads, commissions, and any other fees, to ensure you get value for your money.

Leveraging Technology in Forex Trading

The rise of technology has profoundly impacted the forex trading landscape. Traders can now utilize various tools and platforms to assist their trading endeavors. These include:

- Trading Algorithms: Automated trading systems can execute trades based on predefined criteria, removing emotional decision-making from the process.

- Analytical Software: This software helps traders analyze market data and identify potential trading opportunities through comprehensive analysis.

- Mobile Trading Apps: With the advent of mobile technology, traders can now access the forex market on the go, allowing them to manage their trades anytime and anywhere.

Conclusion

Forex exchange trading is a compelling field that combines opportunity with risk. Understanding the fundamental concepts, employing effective trading strategies, and practicing diligent risk management can lead to success in this fast-paced market. Remember, it is essential to continually educate yourself and stay updated with market trends. Whether you’re a seasoned trader or just starting, resources such as trading-terminal.com can provide valuable insights and tools to enhance your trading experience.